1-year tenancy agreement. No provisions exist for a sales tax or value-added tax VAT at the federal level.

A Checklist For The Malaysia Property Buying Process

Transfer between ASNB funds involves two different Unit Holders of the same fund.

. Usually there are other fees and charges payable such as legal fees for subsidiary documents GST and other disbursements out-of-pocket expenses. Depending on the type of property transaction you will encounter Buyers Stamp Duty BSD Sellers Stamp Duty SSD Additional Buyer Stamp Duty ABSD or stamp duty for rental properties. Elevate your lifestyle in our Sky Rise Residences or premium.

Magicbricks land area calculator helps you convert square feet to square meter Bigha to acre Square feet to acres Square meters to acres all other land units. Pay NO Stamp Duty before September 30. The above calculator is for legal fees andor stamp duty in respect of the principal document only.

The basis and rates of premium differ between the respective states in Malaysia. Transfer of residential property. Stamp duty in Singapore is a type of tax that all homeowners must be familiar with.

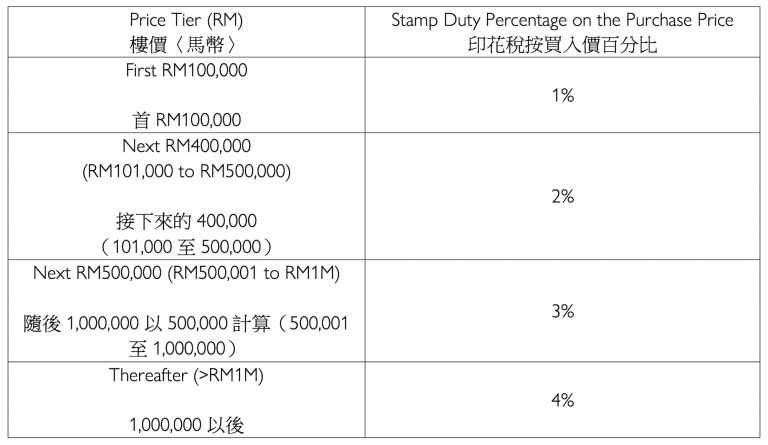

Hover the mouse over a form field and if you see a blue box continue with this step otherwise skip to the next step. Currently stamp duty on transfer of properties is charged as follows. Stamp Duty is the tax levied on legal documents as recompense for making them legally valid.

2Make monthly tax deduction MTD from employees remuneration based on either the Schedule of MTD or the computerized calculation method and remit the amount of MTD to the IRBM on or before the 15th day of the subsequent month. United States Corporate - Other taxes Last reviewed - 01 August 2022. Stamp Duty And Registration.

Australia 108 offers a rare opportunity to live at the highest altitude in the Southern Hemisphere no other address offers the opportunity to live at such amazing heights with exclusive resident facilities akin to the most indulgent hotels. The stamp duty for a tenancy agreement in Malaysia is calculated as the following. Different Transfer Switching.

Land Office Charges will be subject to the official land office charges at each state. One common exception is the acquisition of a single residential property by a Hong Kong SAR permanent resident who does not own any other residential property in Hong Kong SAR at the time of acquisition see 2 below. Income distribution calculation is based on current computation of income distribution for ASNB funds.

TM Share Price Telekom Malaysia Berhad provides integrated telecommunications solutions in Malaysia and internationally. Unit holder A would like to transfer 100 units of ASB to. So another massive saving.

Besides under Love and Affection Stamp Duty Exemption a stamp duty transfer between spouses is 100 exempted. In the state of Karnataka maximum Stamp Duty that can be levied on any rental agreement is INR 500- however it is typically calculated as follows-Up to 10 years 1 of annual rent deposit. Follow Loanstreet on Facebook Instagram for the latest updates.

We will have to increase the price for the LOCAL Selangor land search to RM30 Effective since 19th June 2020. We will have to comply with every rule and regulation. Click anywhere in the blue box the cursor is placed at the right position automatically.

Do take note a property stamp duty can be costly and expensive. However sales and use taxes constitute a major revenue source for the 45 states that impose such taxes and the District of Columbia. The remittance is applicable for all contract notes from Jan 1 2022 to Dec 31 2026 for all stocks listed on Bursa Malaysia it said.

Amanah Saham Malaysia ASM-Amanah Saham Malaysia 2 Wawasan ASM 2 Wawasan. Real Property Gains Tax RPGT is a form of Capital Gains Tax that homeowners and businesses have to pay when disposing of their property in Malaysia. Sample personal income tax calculation.

Learn how to calculate stamp duty from a trusted source with PropertyGuru. The calculation of the additional premium is based on the State Land Rules. If you want to rent out your unit at RM1700 per month your annual rental would be RM20400 RM1700 per month x 12 months.

The company primarily provides personal telephony services such as fixed lines. An example of Car Insurance Premium Calculation for Both Comprehensive and Third Party Fire Theft Coverage West. A page will come up with the price estimation and what the calculation is based upon.

Above 10 years 2 of annual rent deposit. Employer may only use the e-PCB e-Data PCB or e-CP39 applications provided through the IRBMs Official Portal for submission of. In the Budget 2022 announcement the government had proposed to raise stamp duty on share contract notes from 01 per cent to 015 per cent which is equivalent to RM150 for every RM1000.

This means that if one day you decide to sell your house you have to pay taxes on the profit gains if you have any. Stamp Duty Calculation example. Due to the MCO period Selangor land offices are having a new SOP.

Be sure to read through the details to make sure theyre correct. For East Malaysia the basic premium for a new car of each category Comprehensive rate for first RM1000 sum insured from the table above RM2030 for each RM1000 or part thereof on value exceeding the first RM1000. It offers information and communications services and solutions in broadband data and fixed-line for small and medium businesses and corporategovernment customers.

If the value is based upon old information for example if the house has been renovated and more bedrooms and bathrooms added you can submit a request to update the calculation. Also since your husband is required to apply for a new shop loan there is a new Bank loan agreement fee and Valuation Fee. A flat rate of 15 with certain exceptions.

To get a full quote for your particular circumstance please contact. As the first RM2400 is exempted from stamp duty the taxable rental amount would be. If you see a blue box over a form field on hover that means the form is fillable or interactive - it contains fields that you can select or fill in.

A valuation of the land is required because the law requires an additional premium to be paid when an application for a change in category of land use express condition is approved.

Spa Stamp Duty Malaysia And Legal Fees For Property Purchase

Malaysia Property Stamp Duty Calculation Don T Know How To Count Property Stamp Duty Here Is It By Sheldon Property Facebook

Buying A House Here S 2022 Stamp Duty Charges Other Costs Involved

Malaysia Legal Fees Cal Apps On Google Play

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Tenancy Agreement Stamp Duty Malaysia Financial Blogger Ideas For Financial Freedom

Exemption For Stamp Duty 2020 Malaysia Housing Loan

Peps Malaysia Stamp Duty Calculation Follow Peps Malaysia Facebook Page To Get Experts Insights On Property In Malaysia Stampdutymalaysia Pepsmalaysia Propertytaxmalaysia Facebook

Stamp Duty Exemption Under I Miliki Announced By The Prime Minister On 15th July 2022 Publication By Hhq Law Firm In Kl Malaysia

Mot Calculation 2020 Property Paris Star

Malaysia Real Estate Kuala Lumpur Property Legal Fees Stamp Duty Calculation When Buying A House In Malaysia

Stamp Duty Legal Fees New Property Board

How To Calculate Stamp Duty 2022 Malaysia Housing Loan

What You Must Know For Stamp Duty Tax And Exemptions When Buying Industrial Properties In Malaysia Industrial Malaysia

How To Calculate Legal Fees Stamp Duty For My Property Purchased Property Malaysia

Buying Property And Stamp Duty Planning Action Real Estate Valuers

What Is A Trust Deed And Why Is It Important

Exemption For Stamp Duty 2020 Malaysia Housing Loan